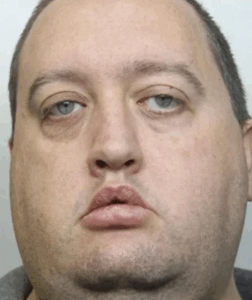

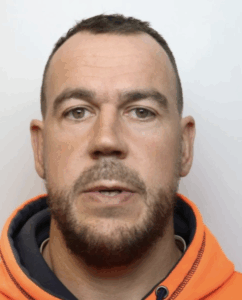

The Financial Conduct Authority (FCA) has achieved a significant legal victory against unauthorised mortgage brokers targeting vulnerable homeowners. London Property Investments (U.K) Limited (LPI), NPI Holdings Limited (NPI), and their directors Daniel Stevens and Tony Stevens have been ordered to pay approximately £4 million for operating without proper authorisation.

The Ruling

In a ruling by Mr Justice Fancourt, the defendants were found guilty of committing “serious contraventions” of financial regulations. LPI arranged mortgages, while NPI bought properties and rented them back to sellers, all without FCA authorisation. The judge described their actions as being “conducted over an extended period, involving high levels of culpability including deception of the consumers and the lenders, and which took advantage of the consumers’ vulnerability.”

The Case

The FCA’s case against LPI, NPI, and their directors highlighted the significant risks posed by unauthorised firms operating in the financial sector. The defendants were found to have systematically deceived vulnerable homeowners, arranging mortgages and conducting property transactions without the necessary regulatory approvals.

LPI and NPI Activities:

- LPI: Arranged mortgages without FCA authorisation.

- NPI: Bought properties and rented them back to the sellers, also without proper authorisation.

FCA’s Response

An FCA spokesperson commented on the ruling: “This judgment is a significant step in protecting consumers from unauthorised financial activities. The defendants took advantage of vulnerable individuals, and this ruling serves as a strong reminder that the FCA will take action against those who operate outside the law.”

Consumer Protection

The case underscores the importance of regulatory compliance in the financial services industry. The FCA is dedicated to protecting consumers, particularly those who are vulnerable, from deceptive practices and ensuring that firms adhere to strict regulatory standards.

Legal Implications

Mr Justice Fancourt’s ruling emphasised the seriousness of the defendant’s actions. The £4 million payment ordered is intended to compensate those affected by the unauthorised activities and serve as a deterrent to others considering similar illegal operations.

Conclusion

The FCA’s victory against LPI, NPI, and their directors marks a significant achievement in the ongoing effort to maintain integrity within the financial services industry. This case highlights the critical role of regulatory bodies in safeguarding consumer interests and upholding the law.