Group of Charities and Non-Profits Urge Prime Minister to Pass Renters Reform Bill

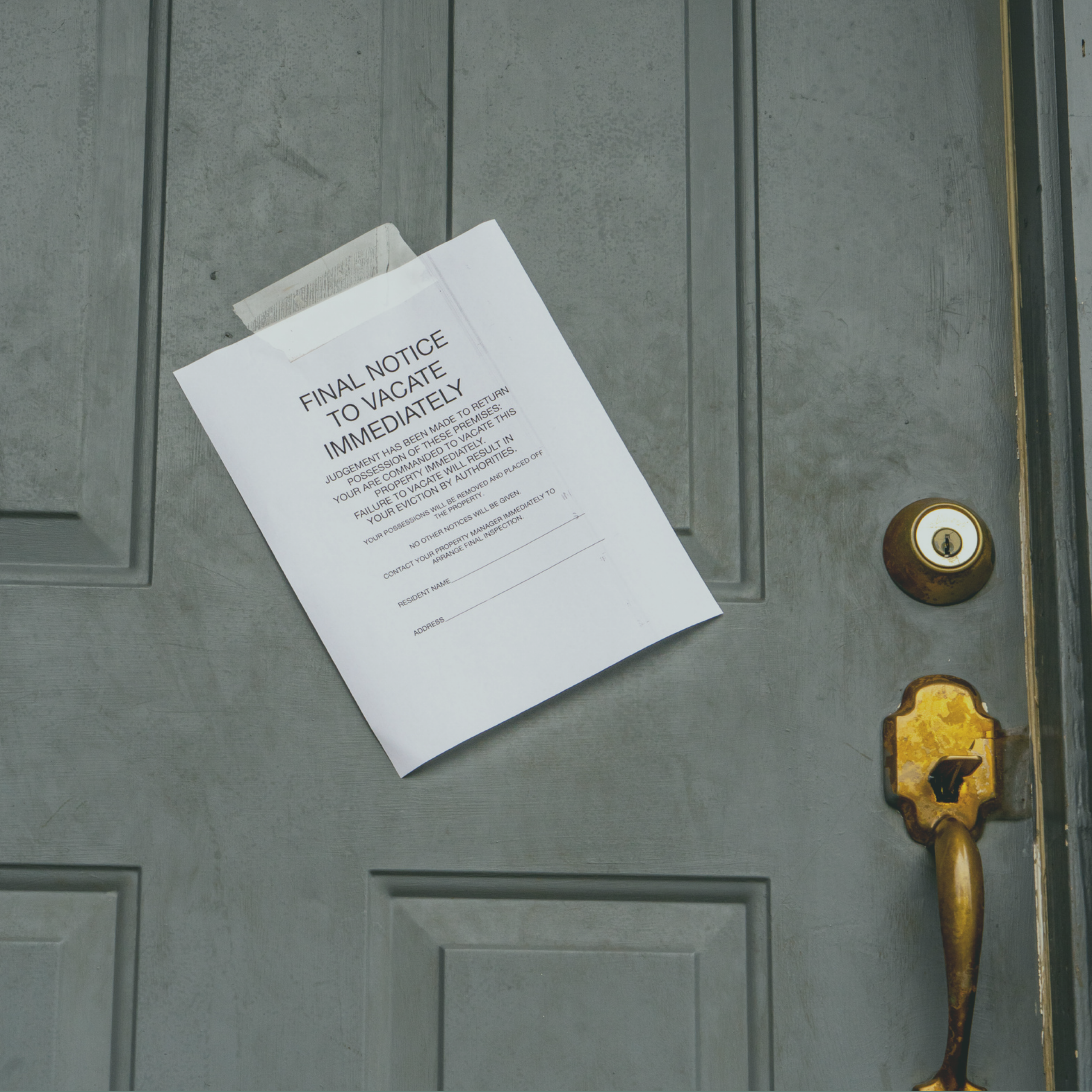

A coalition of 30 charities and non-profit organisations in the UK have come together to call on the Prime Minister to pass the Renters Reform Bill, which aims to ban “no-fault” evictions. This bill would strip landlords in England of their right to evict tenants without reason, providing tenants with a more stable and secure housing situation.

Charities have expressed concerns over the delays in passing the bill, warning that such delays could result in further hardship and suffering for vulnerable renters. They also argue that the current system of no-fault evictions puts an unnecessary burden on taxpayers.

The Conservative party had pledged to implement a ban on no-fault evictions in their manifesto prior to the general election four years ago. In May, the Renters Reform Bill was introduced to Parliament with the aim of fulfilling this promise. However, it has yet to progress to the next stage of parliamentary proceedings.

There are now concerns that there may not be enough time for the bill to pass through Parliament before the next election, which is expected to take place next year. This has prompted charities and non-profits to put pressure on the government to prioritise this legislation and provide renters with the security they deserve.

Currently, under Section 21 of housing legislation, landlords can evict tenants without providing a reason, giving tenants just two months’ notice before eviction proceedings can begin. Shelter, a leading housing charity, has highlighted that their research indicates a renter is evicted every three minutes in England under the no-fault rule.

In order to address this issue and provide greater stability for renters, the Renters Reform Bill needs to be enacted. It is hoped that the government will resume progress on this bill in the near future, prioritising the needs of renters and delivering on their promise of a better deal for those in the rental market.

Former Chairman of Bank of China Arrested on Corruption Charges

Liu Liange, the former chairman of the state-owned Bank of China, has been arrested on suspicion of bribery and giving illegal loans. Liu, who held the position of chairman from 2019 to 2023, had already resigned in March of this year. However, authorities later announced that he was facing corruption charges.

This arrest marks a significant development in President Xi Jinping’s ongoing anti-corruption probe into China’s financial sector, which has targeted high-ranking officials. Liu is one of the most senior bankers to be ensnared in the investigation, highlighting the seriousness with which the Chinese government is addressing corruption within the financial industry.

The crackdown on corruption in China’s financial sector shows no signs of letting up, with officials warning in April that the campaign was far from over. Several other prominent financial executives from state-owned banks have already faced fines, jail sentences, or investigations. Wang Bin, the former chairman of China Life Insurance, was even sentenced to life in prison without parole for bribery.

These efforts to combat corruption and ensure the integrity of China’s financial industry signal the government’s commitment to creating a transparent and accountable banking system. By holding high-level officials accountable for their actions, China aims to restore public trust in its financial institutions and promote a fair and equitable economy.

FTSE 100 Opens Higher on Elevated Oil Prices Amid Escalating Middle East Conflict

The UK’s commodity-focused FTSE 100 index started the week on a positive note, buoyed by elevated oil prices and concerns over the escalating conflict in the Middle East. Both the blue-chip FTSE 100 and the mid-cap index saw gains of 0.3% each.

As Asian equities experienced a slide and the safe-haven dollar remained strong due to increased anxiety over the violence in Gaza and the potential spread of the conflict, crude oil prices held above $90 a barrel after a significant surge on Friday. This rise in oil prices contributed to a 0.6% increase in energy stocks.

Furthermore, industrial metal miners saw a notable jump of 1.3%, tracking the rise in copper prices. Among individual stocks, UK water supplier Severn Trent saw a 1.7% rise after being upgraded by Jefferies to a “buy” rating from “underperform.”

These market movements reflect the impact of geopolitical tensions on global financial markets. The situation in the Middle East has heightened concerns about stability and has led investors to seek refuge in commodities such as oil and metals. The FTSE 100’s positive start to the week indicates the cautious optimism of investors in the face of these uncertain times.